Supply Chain Finance

International Letter of Credit

Domestic and international letters of credit

Domestic letters of credit and international letters of credit are two important tools in trade financing, issued by banks to provide payment guarantees for both buyers and sellers.

Domestic letter of credit

A domestic letter of credit refers to a payment commitment provided by a bank to a buyer in domestic trade within the same country. The buyer's bank issues a letter of credit to the seller, promising to pay the purchase price when specific conditions are met.

characteristic:

Domestic use: limited to trade transactions within the same country.

Bank guarantee: The buyer's bank guarantees the payment to reduce the seller's risk.

Conditional payment: The seller needs to submit documents that comply with the terms of the letter of credit, such as invoices, transportation documents, etc., before the bank can make payment for the goods.

Reduce cash occupation: Buyers can delay payments and improve cash flow.

International letter of credit

International letter of credit refers to a payment commitment issued by a bank in the buyer's country on behalf of the buyer to the seller in international trade. It provides a secure and standardized payment method for cross-border transactions.

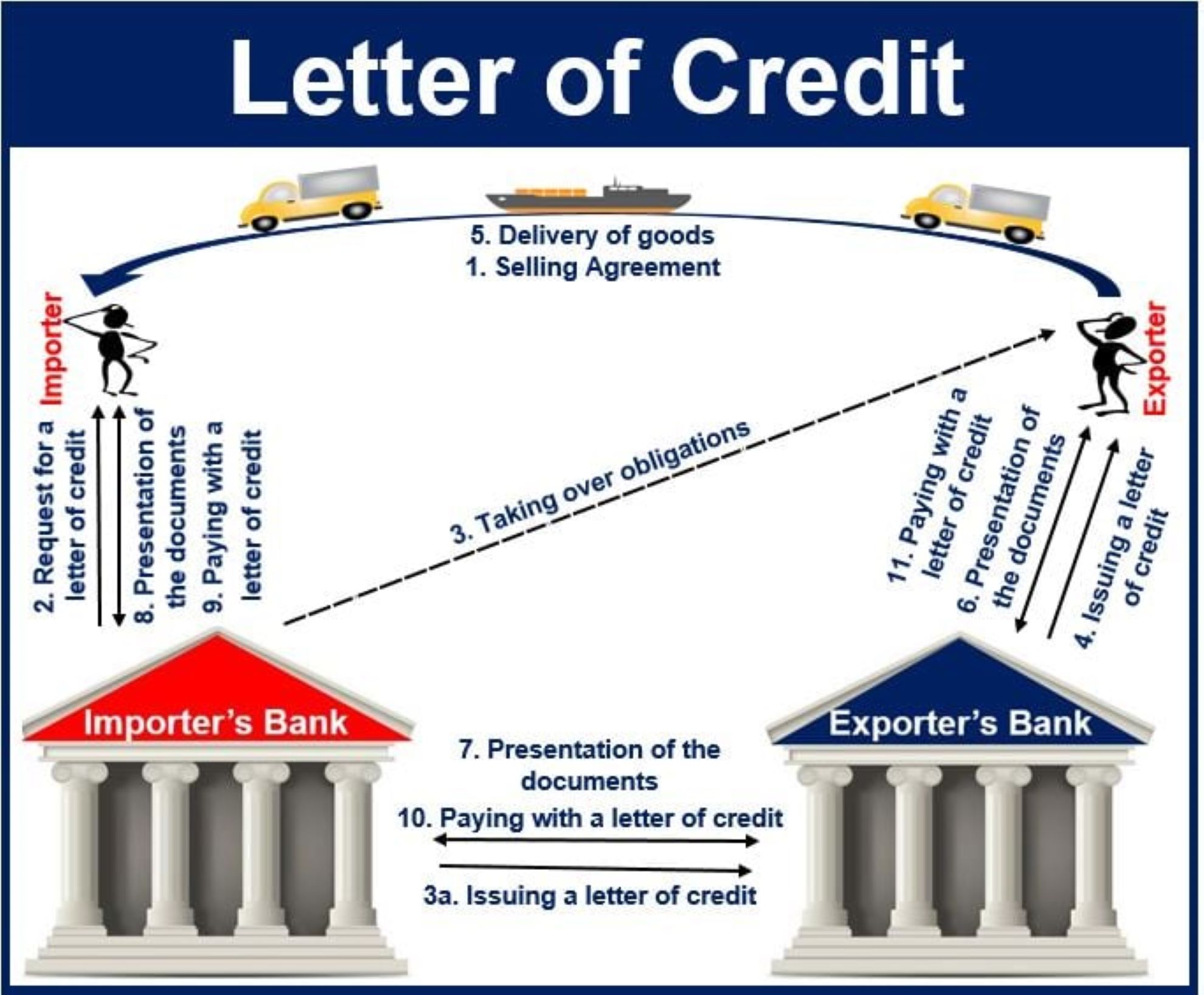

The operation process of an international letter of credit is usually as follows:

Signing contract: The buyer and seller sign a contract that clearly stipulates the use of a letter of credit payment method, and stipulates basic information such as product quantity, unit price, and trade terms.

Application for letter of credit: After receiving the contract, the buyer (customer) shall apply for the opening of a letter of credit at a local bank (issuing bank) in accordance with the contract. After opening the letter of credit, the issuing bank shall send the L/C Draft to the seller (beneficiary of the letter of credit) via email for review by the seller.

Notification: After receiving the letter of credit (in the form of a message), the notifying bank notifies the seller (the biggest advantage of notifying the beneficiary by the notifying bank is security).

Preparation of documents: After receiving the original L/C, the seller shall prepare the corresponding documents (Commercial Invoice) in accordance with the terms and conditions stipulated in the L/C, Packing List,B/L,Insurance Certificate, Certificate of Origin and etc)、 Hurry up stocking and booking.

Submission of documents: The seller shall deliver the original documents to the notifying bank, and the notifying bank shall send them to the issuing bank.

Review documents: The issuing bank will review the documents and then deliver the original documents to the buyer. The buyer will review any discrepancies or confirm payment.

Payment: The notifying bank shall make payment to the seller after deducting bank fees from the payment received

operation flow

Whether it is a domestic letter of credit or an international letter of credit, the business process usually includes the following steps:

1. Letter of Credit Application: The buyer applies to the bank to open a letter of credit.

2. Opening a letter of credit: After the buyer's bank reviews it, a letter of credit is issued to the seller.

3. Notification of Letter of Credit: The seller's bank shall notify the seller upon receipt of the letter of credit.

4. Shipment and submission of documents: The seller shall ship the goods in accordance with the requirements of the letter of credit and submit relevant documents to the bank.

5. Document review: The bank reviews whether the documents submitted by the seller comply with the terms of the letter of credit.

6. Payment for goods: If the documents meet the conditions, the bank will pay the seller for the goods.

7. Transfer or discount: In some cases, the seller may transfer or discount the funds under the letter of credit to other banks or financial institutions.

risk management

Document discrepancy: The documents submitted by the seller must fully comply with the terms of the letter of credit, otherwise the bank may refuse payment.

Credit risk: The credit status of the buyer's bank is crucial to the security of the letter of credit.

Political and legal risks: International trade may be affected by political and legal changes.

advantage

Enhancing trust: providing a foundation of trust for unfamiliar trading parties.

Guarantee payment: Ensure that the seller can receive the payment after meeting the conditions.

Improving cash flow: Buyers can defer payments, while sellers can receive payments in advance.

Domestic and international letters of credit are important tools in trade financing, providing a secure and reliable payment and financing solution for both buyers and sellers through the intervention of banks.